Use an employees Form W-4 information filing status and pay frequency to figure out FIT withholding. The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck.

Federal Income Tax Fit Payroll Tax Calculation Youtube

The withholding tax amount depends on a number of factors so youll need the employees W-4 to help with your calculations as well as the withholding tax tables and the IRS.

. The amount you earn. Here are the steps to calculate withholding tax. Taxpayers in Maine or Massachusetts have until April 19 2022 to file their returns due to the Patriots Day holiday in those states.

26 percent and 28 percent. The Medicare tax rate is 145. For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

For example for 2021 if youre single and making between 40126 and 85525 then you are. The calculator will calculate tax on your taxable income only. FICA taxes consist of Social Security and Medicare taxes.

The AMT is levied at two rates. In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E. FICA taxes are commonly called the payroll tax.

Your filing status and taxable income such as your wages will determine what bracket youre in. These amounts are paid by both employees and employers. In 2021 the 28 percent AMT rate applies to excess AMTI of 199900 for all taxpayers 99950 for married couples filing separate returns.

You pay the tax as you earn or receive income during the year. For 2021 this deduction is generally limited to the greater of 1 1100 or 2 the individuals earned income plus. Generally deductions lower your taxable income by the percentage of your highest federal income tax bracket.

For the 2021 tax year there are seven federal tax brackets. Your net income gets calculated by removing all the deductions. Federal Income Tax Tables 2021.

First gather all the documentation you need to reference to calculate withholding tax. Depending on the W-4 conditions an employee may have more or less tax liability. The deadline to submit 2021 tax returns or an extension to file and pay tax owed this year falls on April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia.

What is Tax Withholding. If we add up the two tax amounts. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

This is 548350 in FIT. There are seven federal income tax rates in 2022. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

See 2021 Tax Brackets. Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax FIT. Fit stands for Federal Income Tax Withheld.

Also calculated is your net income the amount you have left. Standard Deduction for Dependents. 69400 wages 44475 24925 in wages taxed at 22.

The calculated income tax for Fed or State is an Estimate of the tax liability of the employee and is based on the W-4 conditions Pay cycle and the Gross earning amount of the paycheck. You can use the Tax. Does not include self-employment tax for the self-employed.

The AMT exemption amount for 2021 is 73600 for singles and 114600 for married couples filing jointly Table 3. For 2022 employees will pay 62 in Social Security on the first 147000 of wages. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas.

If youre an employee your employer probably withholds income tax from your paycheck and pays it. 4664 548350 1014750 total FIT to be withheld from all checks this year. The percentage of tax withheld from your paycheck depends on what bracket your income falls in.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. This tax will apply to any form of earning that sums up your income whether it comes for employment or capital gains. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

For help with your withholding you may use the Tax Withholding Estimator. The information you give your employer on Form W4. However they dont include all taxes related to payroll.

So if you fall into the 22 tax bracket a. Federal Income Tax Tables 2021. Does not include income credits or additional taxes.

The amount of income tax your employer withholds from your regular pay depends on two things. The federal income tax is a pay-as-you-go tax. The standard deduction for an individual who can be claimed as a dependent on someone elses return is limited.

For employees withholding is the amount of federal income tax withheld from your paycheck. The government uses federal tax money to help the growth of the country and maintain its upkeep. New hires must fill out Form W-4 Employees Withholding Certificate when they start working at your business.

10 12 22 24 32 35 and 37. Federal Income Tax or FIT is the amount withheld from an employees paycheck which goes toward their Federal Income Tax liability at the end of the year.

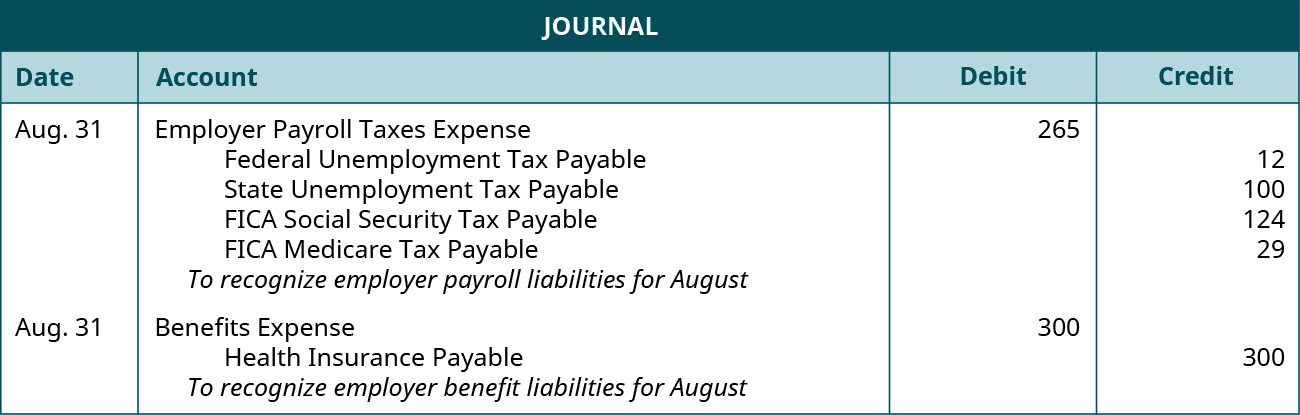

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Understanding Your Pay Statement Office Of Human Resources

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Different Types Of Payroll Deductions Gusto

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Mathematics For Work And Everyday Life

Mathematics For Work And Everyday Life

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

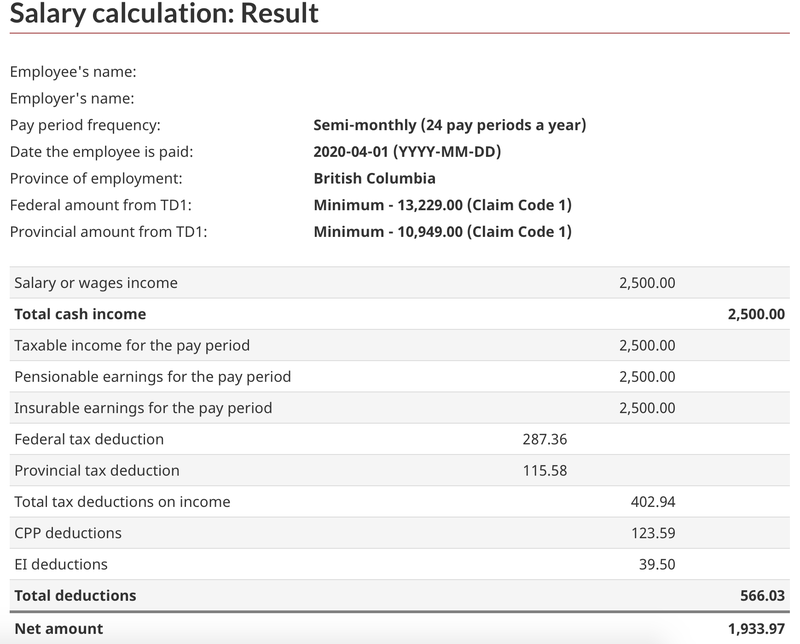

How To Do Payroll In Canada A Step By Step Guide The Blueprint

How To Do Payroll In Excel In 7 Steps Free Template

Paycheck Taxes Federal State Local Withholding H R Block

What To Do When Employee Withholding Is Incorrect Cpa Practice Advisor

Understanding Your Paycheck Credit Com

Payroll Expense Journal Entry How To Record Payroll Expense And Withholdings Youtube

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Tax Vs Income Tax What S The Difference The Blueprint